capital gains tax changes canada

The below outlines the current tax treatment of capital gains in Canada and the US the appetite for change in each country and a few questions to ask your financial planner. Your sale price 3950- your ACB 13002650.

Understanding Taxes And Your Investments

The taxes in Canada are calculated based on two critical variables.

. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. As of 2022 it stands at 50. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the.

If the beneficiary has not claimed his or her lifetime capital gains exemption in 2017 the exemption is 835714 he or she may claim such exemption to shelter all or a part. For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. The gain and any rental income is attributed for tax purposes to the spouse who paid for the property.

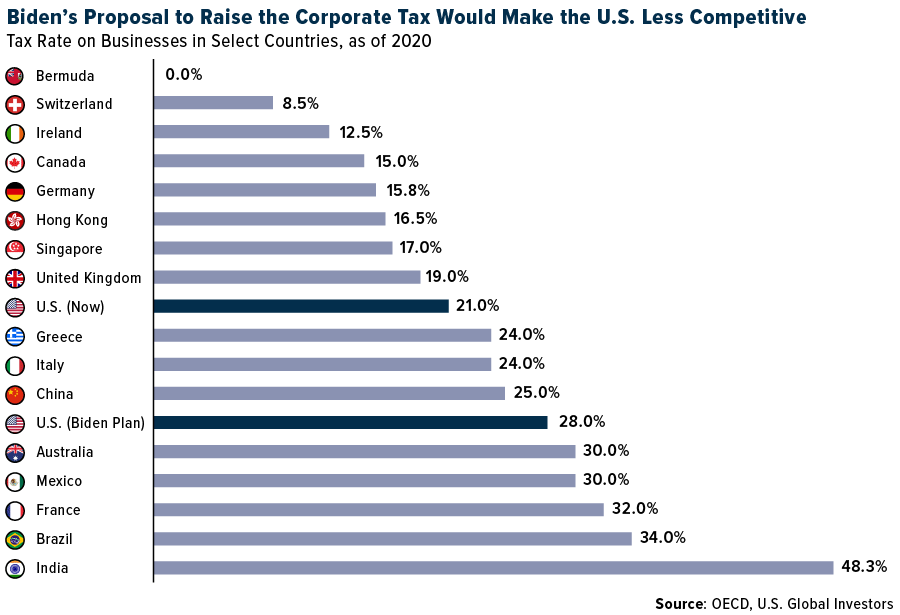

The Liberals plan to increase taxes for high-income earners and to cut taxes for their newly-defined middle class in Canada. Tax Changes in 2022. Is more mixed where capital.

Federal Tax Rate Brackets in 2022. In other words for every 100 of. Currently depending on your tax bracket a capital gain is taxed at a rate.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Edit for your edit. January 1 2022 marks the 50th anniversary of the capital gains tax in Canada.

Was introduced in 1965. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. The current tax preference for capital gains costs 35 billion annually with high-income families accruing most of the benefit.

The government would like to see the tax rate on both capital gains and dividend income be the same. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. For more information see What is the capital gains deduction limit.

In this article we outline the history of capital gains taxation in Canada describe some of the key. On July 18 2017 Finance Minister Bill Morneau released a consultation paper and a draft legislative proposal to amend the Income Tax Act Canada. So if you make 1000 in capital gains on an investment you will pay capital gains tax on.

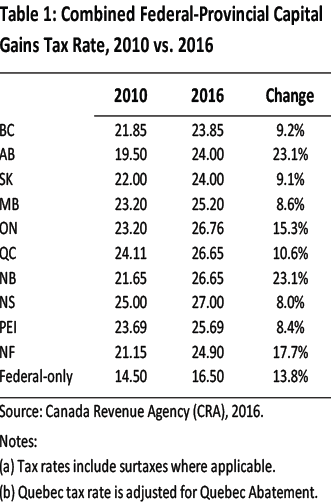

If you bought a cottage for 200000 and now sell it for 500000 you will receive. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. An individual resident of the United States acquired real property situated in Canada on January 1 1978 for 100000.

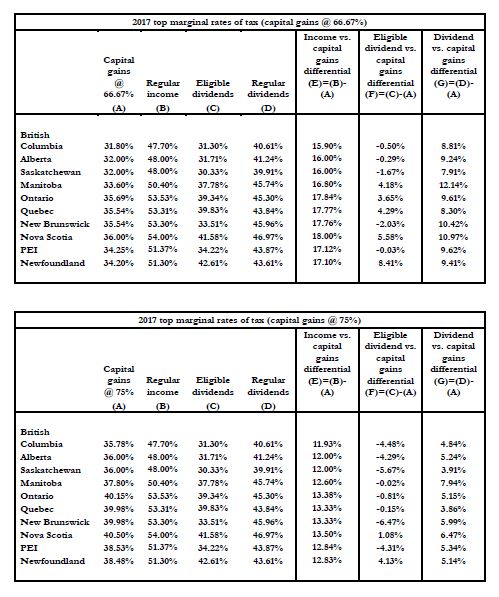

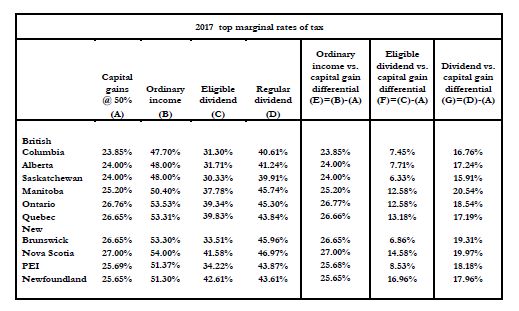

When you buy a home you must pay tax on its fair market value at the time of purchase. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338. The experience in the US.

The inclusion rate has varied over time see graph below. The federal income tax brackets. The capital gain of.

The recent passage of Bill C-208 exacerbates. The inclusion rate refers to how much of your capital gains will be taxed by the CRA. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have. Since its more than your ACB you have a capital gain. A comprehensive capital gains tax in the UK.

Australia introduced a similar tax later in 1985. There are seven federal income tax rates in 2023. The new government plans to reduce the federal.

If you both paid for the house 5050 thats how the gain has. The property was sold April 30 1986 for 150000.

Personal Income Taxes And The Capital Gains Tax Fraser Institute

Planning Around The 2017 Federal Budget Possible Changes To The Capital Gains Inclusion Rate Tax Authorities Canada

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Planning Around The 2017 Federal Budget Possible Changes To The Capital Gains Inclusion Rate Tax Authorities Canada

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Taxes On Capital Income Are More Than Just The Corporate Income Tax

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

:format(webp)/https://www.thestar.com/content/dam/thestar/business/opinion/2022/02/26/the-50-per-cent-inclusion-rate-on-capital-gains-benefits-mostly-the-rich-its-time-to-bump-it-up/capital_gains_tax.jpg)

The 50 Per Cent Inclusion Rate On Capital Gains Benefits Mostly The Rich It S Time To Bump It Up The Star

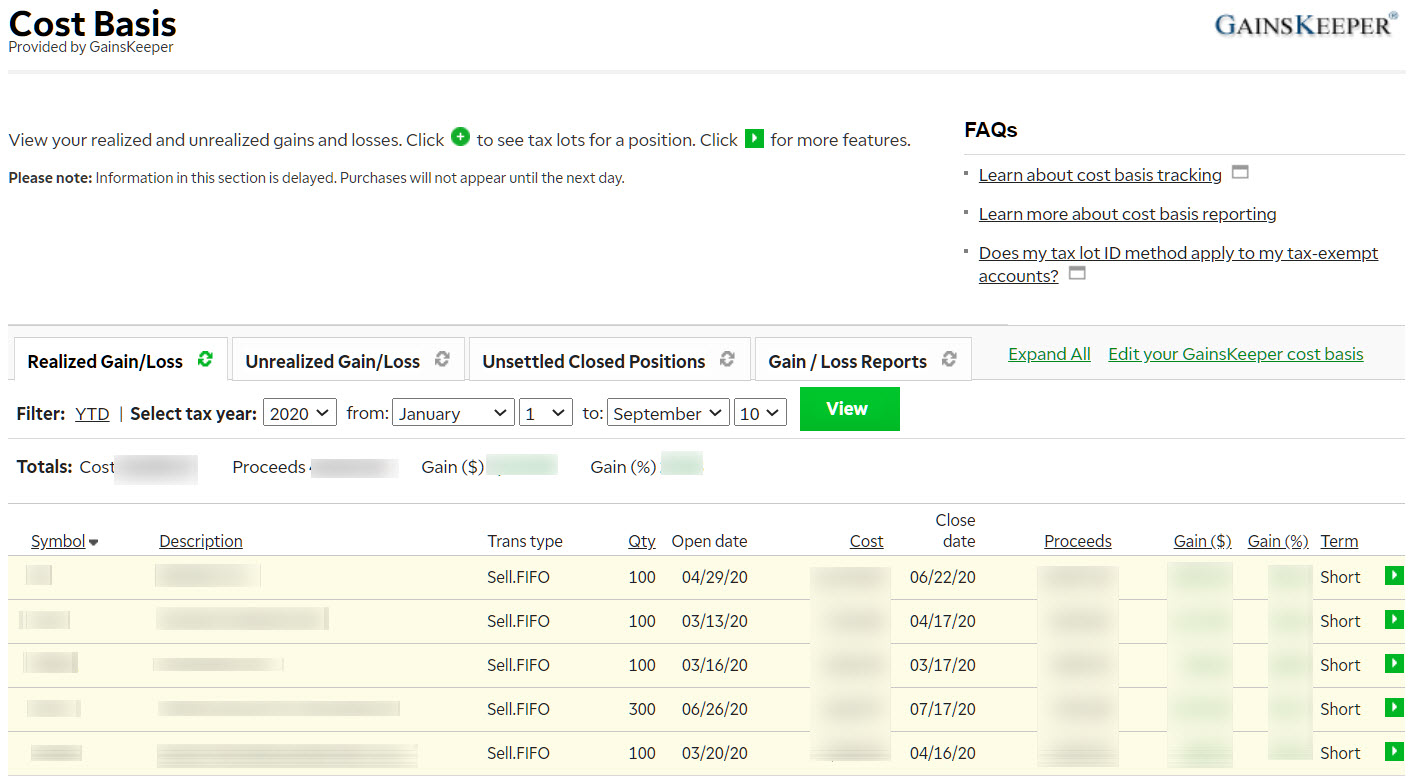

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Stock Market News Live Updates Stocks Rise Shaking Off Capital Gains Tax Increase Concerns Capital Gains Tax Capital Gain Stock Futures

2021 Capital Gains Tax Rates In Europe Tax Foundation

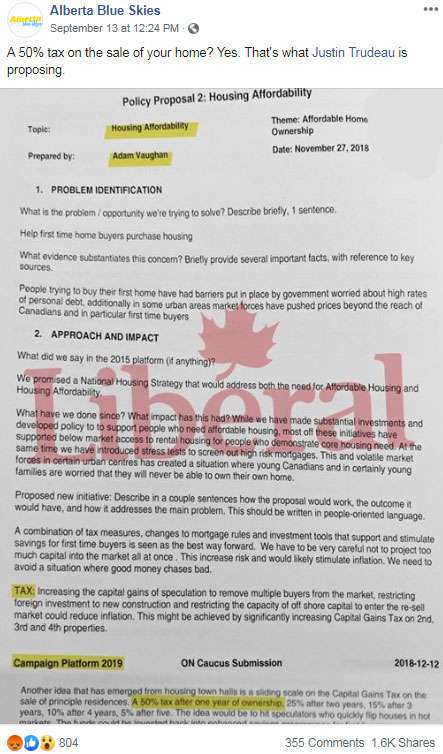

Fact Check Canada S Liberals Plan Capital Gains Tax On Home Sales

Tax Policy And Economic Inequality In The United States Wikipedia

Understanding Capital Gains Tax In Canada

Capital Gains And Losses Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)